Auto Loans

Auto loan rates as low as 4.95%*

New or used, lease-buyouts, & refinancing options available.

We provide links to third party websites, independent from Towpath CU. These links are provided only as a convenience. We do not manage the content of those sites. The privacy and security policies of external websites will differ from those of Towpath CU. Click "CONTINUE" to proceed or click the "RETURN TO SITE" to stay on this site.

Auto loan rates as low as 4.95%*

New or used, lease-buyouts, & refinancing options available.

New or Used

Get Pre-Approved First

Dealers or Private Sales

Refinance your auto loan with Towpath Credit Union and drive into a future of savings and smarter financial choices. Enjoy lower rates, flexible terms, and exceptional Member service that sets us apart from other lenders.

Buyout Your Lease

Keep Your Vehicle

Take Advantage of Towpath CU Interest Rates

You can apply for an auto loan purchase or refinance loan without a hard credit inquiry**! This way, you can find out which terms and rates you're eligible for without a hard credit inquiry, which could unnecessarily lower your credit score. If you decide not to move forward with the loan, we don't move forward with the inquiry! Once you are approved and agree to proceed with the loan, a hard credit pull will be conducted and a new trade-line on your credit report may impact your credit.

GAP helps cover the difference between the actual cash value of the vehicle (primary insurance company settlement) and the outstanding loan balance at the time of a total loss.

When buying any vehicle, there is always a chance of having a mechanical breakdown. Mechanical breakdowns can be very expensive to repair. With a vehicle service contract from Vision Warranty Corporation, you can add protection against the unexpectedly high cost of vehicle repairs, in some cases eliminating the cost altogether.

Depreciation Protection kicks in if your vehicle is ever totaled or stolen and not recovered at any time over the life of the loan. It waives some or all of your loan balance in the event of the total loss of your vehicle. The waiver benefit is equal to the difference between your vehicle’s MSRP or retail value at the time of DPW purchase, less the amount of your loan balance at the time of total loss. (The benefit cannot exceed the DPW addendum limit or your outstanding loan balance at the time of total loss.)

Benefit triggered by collision or comprehensive total loss, including theft

Life of loan protection

No mileage, make, or year restrictions

Open enrollment

100% refundable for first 60 days

Accidental Death protection included, which provides for cancellation of up to $1,000 of your outstanding loan balance if you die in an accident

Protect the things that matter most.

If your life takes an unexpected turn, your family’s finances can be strained. But with Everyday Debt Defender, your loan payments or balance may be canceled, up to the contract maximums, in case of involuntary unemployment, disability, or death. It’s just one more way you can look out for the people you love.

Your purchase of Everyday Debt Defender is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions and exclusions may apply. Please contact your loan representative or refer to the Member Agreement for a full explanation of the terms of Everyday Debt Defender. You may cancel the protection at any time. If you cancel protection within 30 days, you will receive a full refund of any fee paid.

*APR = Annual Percentage Rate.

APR applies to loans on 2025 or newer autos only with 5000 miles or less financing $10,000.00 & under. Loans over

$10,000.00 require a prepaid finance charge which will affect the final APR. Rates, terms and conditions are subject to

change and may vary based on applicant creditworthiness, loan qualifications, and collateral condition. All loans are

subject to approval. Refinance applies only to loans from other lenders. Contact one of our friendly loan processors for

complete details. An example payment on a $10,000.00 loan for 72 months at 4.95% APR would be approximately

$161.15 per month. An example payment on a $25,000.00 loan including a $150.00 prepaid finance charge for 72

months at 4.95% interest rate (5.16% APR) would be approximately $402.87 per month without optional debt

protection. All rates are subject to change without notice.

**Credit Score/Hard Inquiry disclosure: To check the rates and terms you may qualify for, we conduct a soft credit pull that does not affect your credit score. However, if you choose one of our offered loan terms and continue your application, we will request your full credit report which will be considered a hard credit pull and may affect your credit score.

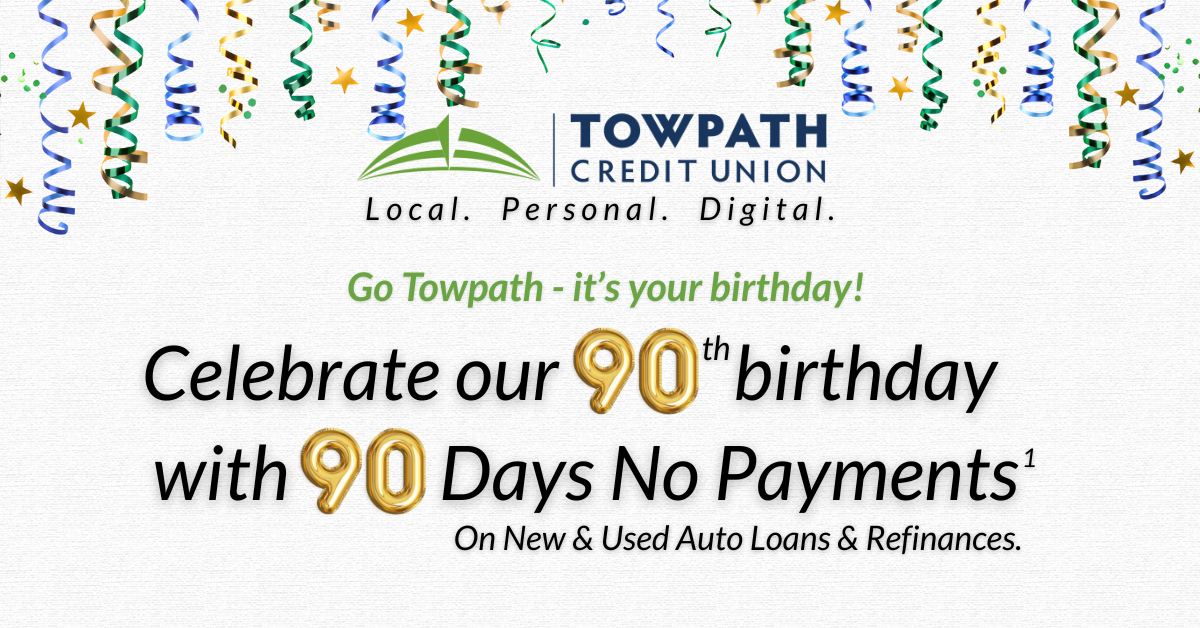

1 Restrictions may apply and offer is subject to loan approval. Offer eligible for new and used Auto Loans, and refinances of non-Towpath Credit Union Auto Loans only. Interest will begin to accrue immediately upon loan funding, continue for the 90 Day No Payment Period and the remainder of the loan term. Offer valid through April 30, 2026 and is subject to change without notice.

Total Balance

Compound Frequency

Daily

Monthly

Quarterly

Annually

Total Balance

Monthly

Quarterly

Annually

Monthly Payments

Loan Amount

Monthly Payments

| Date | Principal | Interest | Total Interest | Balance |

|---|

Original monthly payment

Original Remaining Cost

New monthly payment

New Mortgage Cost

Refinancing will save you per month and save you in total cost.